Offshore Trust Services - Questions

Wiki Article

Offshore Trust Services Fundamentals Explained

Table of ContentsThe 10-Second Trick For Offshore Trust ServicesTop Guidelines Of Offshore Trust ServicesOffshore Trust Services Fundamentals ExplainedSee This Report about Offshore Trust ServicesThe smart Trick of Offshore Trust Services That Nobody is Talking About

Even if a financial institution can bring a deceptive transfer insurance claim, it is hard to prosper. They need to show beyond a practical question that the transfer was made with the intent to defraud that particular lender and that the transfer left the borrower insolvent. Lots of overseas asset security intends entail even more than one legal entity.

citizen can develop an offshore trust fund and also an U.S. minimal partnership or an overseas minimal liability firm. Most overseas LLCs are formed in Nevis, which for a long time has actually been a preferred LLC jurisdiction. Nevertheless, recent changes to Nevis tax obligation and declaring needs have actually led to LLCs in the Chef Islands.

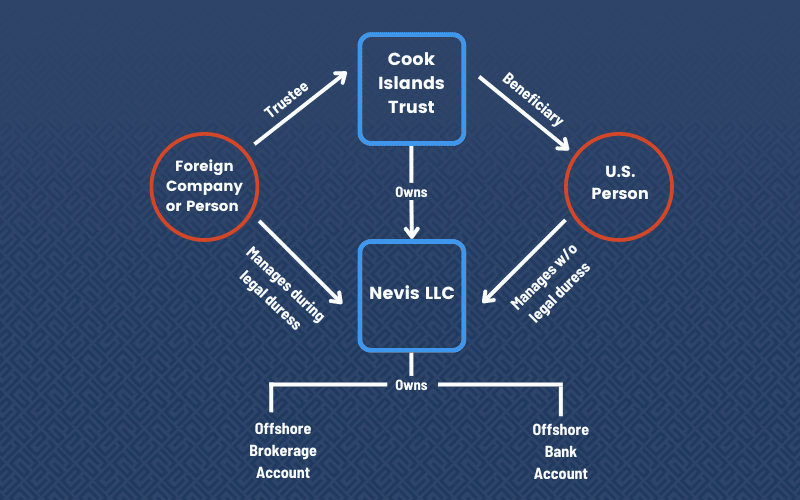

individual can create a Nevis LLC as well as transfer their organization interests and liquid properties to the LLC. The person can next off establish a Cook Islands trust fund using an offshore trust company as a trustee. The LLC concerns subscription passions to the trustee of the Chef Islands depend on. The Chef Islands count on would possess 100% of the Nevis LLC.

With this type of overseas count on framework, the Nevis LLC is taken care of by the U.S. individual when there are no expected lawsuits. When a lawful concern arises, the trustee of the overseas depend on ought to remove the United state

Supply all needed files for the trustee's due diligence. Compose the offshore depend on record with your lawyer. Fund the trust by transferring domestic properties to the overseas accounts. The initial step to forming an offshore depend on is selecting a trust jurisdiction. offshore trust services. In our experience, the Chef Islands provides the most effective mix of trustee regulation, positive debtor legislations, and also favorable lawsuits results contrasted to various other territories.

The trustee business will certainly utilize software application to confirm your identity and explore your present legal circumstance in the U.S. Count on firms do not desire clients that may entail the firm in investigations or lawsuits, such as conflicts including the united state federal government. You must divulge pending lawsuits and also examinations as part of the history check.

additional reading

Offshore Trust Services - Questions

Many people pass the background check without concern. Your domestic possession protection attorney will certainly deal with the overseas trustee business to draft the offshore count on contract. If you consist of other entities in the structure, such as a Nevis LLC, the lawyer will additionally compose the contracts for those entities. The trust agreement can be personalized based on your asset defense as well as estate planning objectives.

accountancy companies, and also they supply the audit results and their insurance policy certifications to potential overseas count on customers. Most individuals want to keep control look at here now of their very own assets held in their offshore count on by having the power to eliminate and replace the trustee. Maintaining the power to change an overseas trustee develops legal threats.

Offshore trust property defense works best if the trustmaker has no control over count on possessions or other celebrations to the trust fund. Some trustee firms permit the trustmaker to get main discretion over trust investments and account administration in the position of depend on consultant.

The trustmaker does not have straight access to overseas count on financial accounts, but they can ask for distributions from the overseas trustee The possibility of turn over orders and also civil contempt charges is a substantial risk in overseas asset protection. Debtors counting on overseas trust funds should think about the opportunity of a residential court order to revive assets moved to a borrower's overseas count on.

In circumstances when a court orders a debtor to unwind an offshore count on strategy, the debtor can assert that compliance is difficult because the depend on is under the control of an offshore trustee. Some current court decisions treat a transfer of assets to an offshore trust fund as an intentional act of creating an impossibility.

The Fannie Mae company got a money read the article judgment versus the debtor. The debtor had moved over $7 million to an offshore trustee. The trustee after that moved the same cash to a foreign LLC of which the debtor was the sole member. The court bought the borrower to revive the cash to pay the Fannie Mae judgment.

Offshore Trust Services Fundamentals Explained

The overseas trustee declined, and he said that the cash had actually been purchased the LLC (offshore trust services). The court held the borrower in ridicule of court. The court found that regardless of the rejection by the overseas trustee, the borrower still had the capacity to access the funds as the sole participant of the LLC.Report this wiki page